12 Best Risk Management Software Shortlist

I've assessed 12 top risk management tools, choosing the best to address your specific challenges and fill vital gaps in your strategy.

- Alyne - Best for comprehensive compliance solutions

- Riskonnect - Best for integrating risk management information

- Cority - Best for environmental and occupational safety

- Lockpath Keylight Platform - Best for governance, risk, and compliance needs

- Splunk Enterprise - Best for incident management analytics

- Resolver - Best for global risk analysis

- SAI360 - Best for integrated governance, risk, and compliance

- Essential ERM - Best for enterprise risk management

- AMLYZE - Best for cryptocurrency risk assessment

- Drata - Best for automated security compliance

- LogicGate Risk Cloud - Best for flexible risk program management

- Diligent - Best for IT risk management solutions

Navigating the intricate landscape of vulnerabilities and security risks is a daunting task for any organization. As someone who's grappled with the complex web of information security, I've come to appreciate the immense value of risk management software. This tool simplifies the process of identifying and addressing potential threats, ensuring business continuity, and maintaining a robust risk register.

Particularly useful for sectors like healthcare and business processes, these software solutions, available both as SaaS and on-premise, enable stakeholders to monitor metrics, manage third-party risks, and ensure operational risk management efficiently. So, if you're weary of juggling countless spreadsheets or manually tracking each vulnerability, I believe these software options might be the remedy you've been seeking.

What Is Risk Management Software?

Risk management software is a technological solution employed by businesses, government organizations, and various industry professionals to identify, assess, and prioritize risks. This software aids in systematically applying policies, procedures, and practices to analyze potential threats and uncertainties, allowing users to create strategies to minimize or completely mitigate the associated risks.

Whether used for financial, operational, compliance, or strategic risks, these tools enable organizations to make more informed decisions, aligning with the overall objectives and enhancing the resilience and success of the business.

Overviews of the 12 Best Risk Management Software

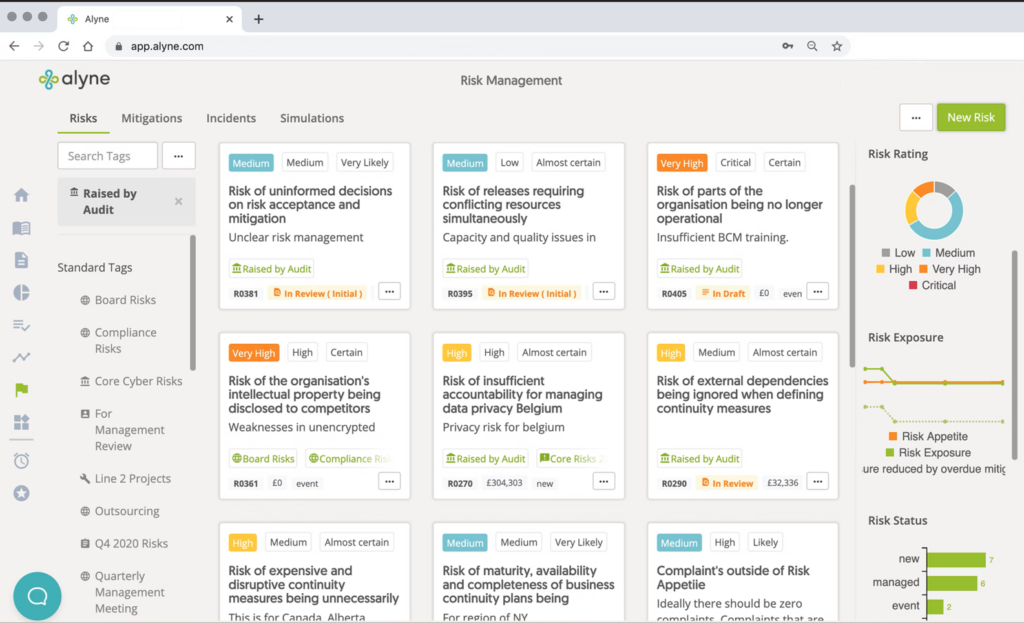

1. Alyne - Best for comprehensive compliance solutions

Alyne is a software platform designed to provide robust compliance solutions for organizations. Offering extensive features that facilitate the management of compliance across various regulations, standards, and frameworks, allows businesses to stay aligned with legal requirements and industry standards.

Its excellence in delivering comprehensive compliance solutions underpins the rationale for being recognized as the best in this category.

Why I Picked Alyne:

I chose Alyne after carefully comparing features that facilitate the alignment of legal and business compliance needs. Its unique approach to providing a centralized compliance structure makes it stand out among competitors.

Being best for comprehensive compliance solutions, it enables organizations to keep abreast of ever-changing regulations effortlessly.

Standout Features & Integrations:

Alyne's key features include risk identification, compliance mapping, continuous monitoring, and reporting capabilities, all of which contribute to an organization's adaptability to legal requirements. Its integration with existing systems and third-party applications allows for a cohesive workflow, simplifying the process of managing complex compliance structures.

Pricing:

From $20/user/month (billed annually)

Pros:

- Centralized compliance structure

- Continuous monitoring and reporting capabilities

- Compatibility with various regulations and standards

Cons:

- Annual billing may not suit all budgets

- Initial setup can be complex for small businesses

- Limited customization options in the base package

2. Riskonnect - Best for integrating risk management information

Riskonnect provides a centralized platform for efficiently integrating risk management information across the organization. By streamlining the entire process of collecting, analyzing, and disseminating risk data, Riskonnect facilitates well-informed decision-making. This seamless integration of risk information is why it's been recognized as the best for this specific use case.

Why I Picked Riskonnect:

I chose Riskonnect after determining its unique capability to bring all risk management information into a unified view. Its ability to link risk information with the business strategy stood out during my evaluation process, making it an exceptional choice for those seeking a comprehensive risk view.

Riskonnect is best for integrating risk management information, ensuring that data-driven insights are readily available to guide the organization's direction.

Standout Features & Integrations:

Riskonnect offers features like risk data collection, real-time analytics, visualization tools, and centralized reporting. These features help organizations to have a coherent and consolidated view of risks.

It integrates with various other business tools and systems, enabling a smooth exchange of information, and therefore providing a comprehensive view of the organization's risk landscape.

Pricing:

From $25/user/month (billed annually, min 5 seats)

Pros:

- Centralized platform for risk information

- Real-time analytics and visualization tools

- Smooth integration with other business systems

Cons:

- Minimum seat requirement may exclude small businesses

- A learning curve for some users

- Limited functionality in the lowest-tier package

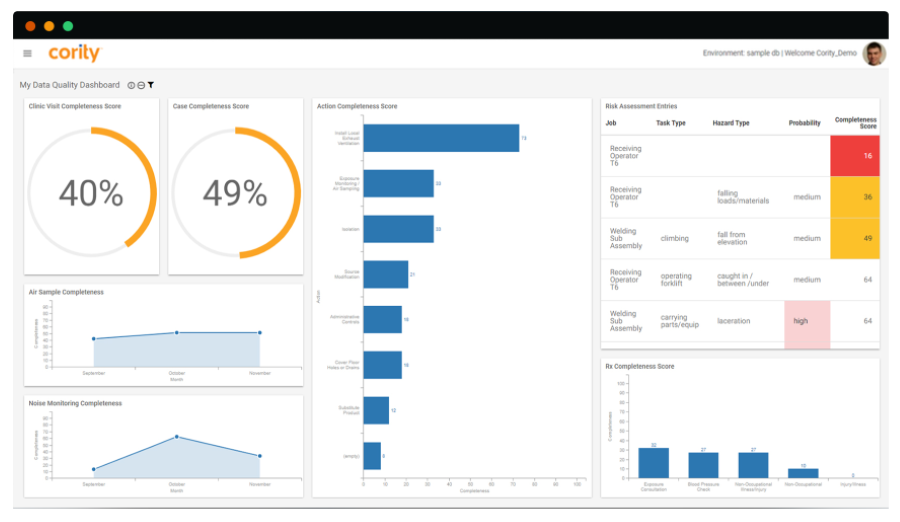

3. Cority - Best for environmental and occupational safety

Cority offers a dedicated solution for managing environmental and occupational safety within organizations. By focusing on these specialized areas of risk, Cority provides tools that allow companies to proactively address safety concerns and maintain compliance with relevant regulations.

Its emphasis on both environmental and occupational safety makes it the best choice for organizations looking to tackle these specific challenges.

Why I Picked Cority:

I chose Cority due to its well-structured approach to handling both environmental and occupational safety risks. In comparing various platforms, Cority's commitment to these specific areas stood out, offering targeted solutions that cater to the unique requirements of safety management.

It's clear that Cority is best for environmental and occupational safety, thanks to its dedicated functionality and attention to industry standards.

Standout Features & Integrations:

Cority’s key features include compliance tracking, incident management, safety internal audit, and reporting tools. These are essential in promoting a safe work environment and ensuring that environmental standards are upheld.

Integrating with various other safety and environmental systems, Cority offers a seamless connection between different areas of safety management, thereby enhancing overall efficiency and compliance.

Pricing:

From $30/user/month (billed annually, min 5 seats)

Pros:

- Dedicated solutions for environmental and occupational safety

- Robust compliance tracking and reporting tools

- Integration with various other safety systems

Cons:

- Minimum seat requirement may be a barrier for smaller businesses

- Limited functionality in areas outside environmental and occupational safety

- Potential complexity in setup and configuration for newcomers

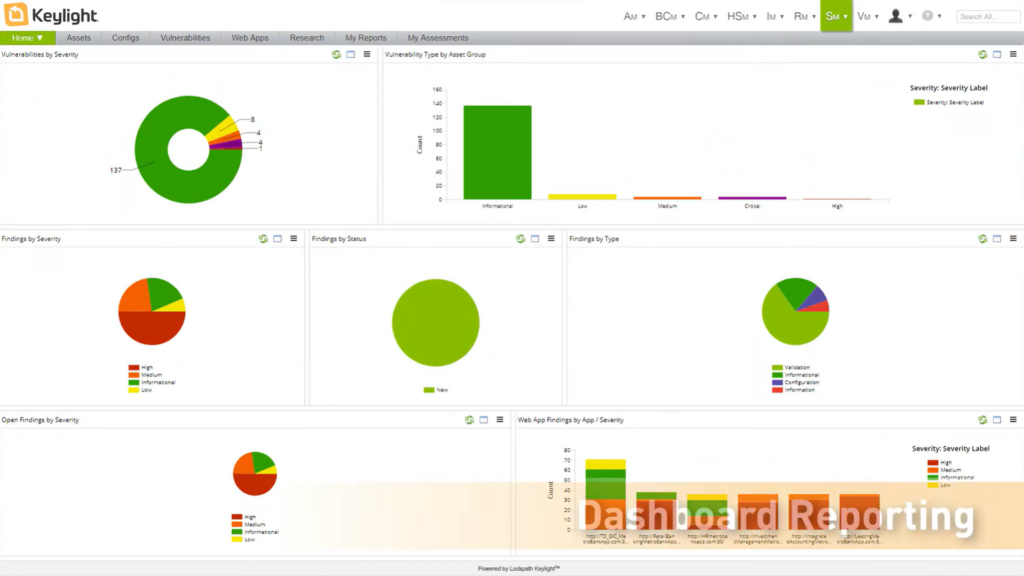

4. Lockpath Keylight Platform - Best for governance, risk, and compliance needs

Lockpath Keylight Platform is designed to serve organizations with comprehensive governance, risk, and compliance (GRC) requirements. Tailored to handle the complexities of these three crucial areas, Keylight offers an integrated platform that supports a wide range of industry standards, making it the best choice for GRC needs.

Why I Picked Lockpath Keylight Platform:

I chose Lockpath Keylight Platform after careful comparison and judgment of various GRC tools for HIPAA, ITRM, AICPA SOC 1, SOC 2, GDPR, ISO 27001 and more. Its ability to provide a unified platform for governance, risk, and compliance distinguished it from others.

The cohesive management of these elements ensures efficiency and accuracy, supporting why I found it to be the best for governance risk compliance needs.

Standout Features & Integrations:

Lockpath Keylight offers features like risk assessment methodology, policy management, audit management, and real-time reporting. These functionalities are essential for managing GRC in a streamlined manner.

Furthermore, the platform integrates with popular business intelligence tools and other GRC solutions, enabling a comprehensive and unified approach to risk management.

Pricing:

Pricing upon request

Pros:

- Unified platform for governance, risk, and compliance

- Supports a wide range of industry standards

- Offers integration with various business intelligence tools

Cons:

- Pricing information is not readily available

- May require significant time to implement and configure

- Complexity might be overwhelming for smaller organizations

5. Splunk Enterprise - Best for incident management analytics

Splunk Enterprise is designed to provide incident management analytics, making it an essential tool for organizations needing real-time insights into incidents and events. With powerful search and investigative capabilities, it helps in quick analysis and response to incidents, thereby standing out as the best for incident management analytics.

Why I Picked Splunk Enterprise:

I chose Splunk Enterprise for its unique capability to analyze and visualize machine data from various sources. After careful comparison and judgment, I determined that its robust search functionality and flexible dashboards set it apart from other solutions.

It is my opinion that Splunk Enterprise's ability to transform data into actionable insights makes it the best tool for incident management analytics.

Standout Features & Integrations:

Splunk Enterprise offers features like real-time search, monitoring, analysis, and visualization of machine-generated data. These features enable efficient incident response and management.

The platform integrates seamlessly with many third-party applications, including security information, event management systems, and other data sources, ensuring comprehensive incident analysis.

Pricing:

From $150/user/month (billed annually)

Pros:

- Extensive search and analytics capabilities for incident management

- Integration with numerous third-party applications

- Real-time monitoring and alerting functionality

Cons:

- Complexity in setup and configuration

- Pricing might be high for small to medium enterprises

- May require specialized training to fully utilize all features

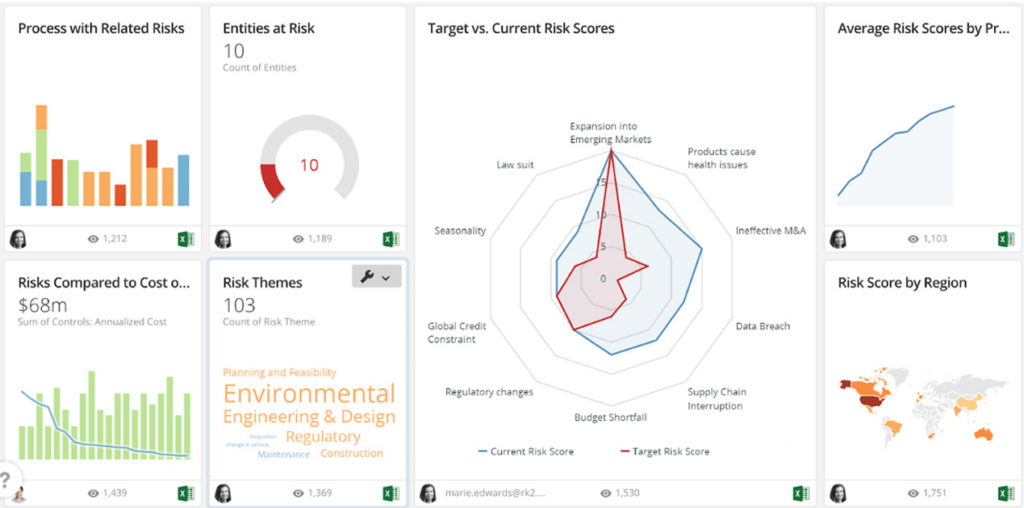

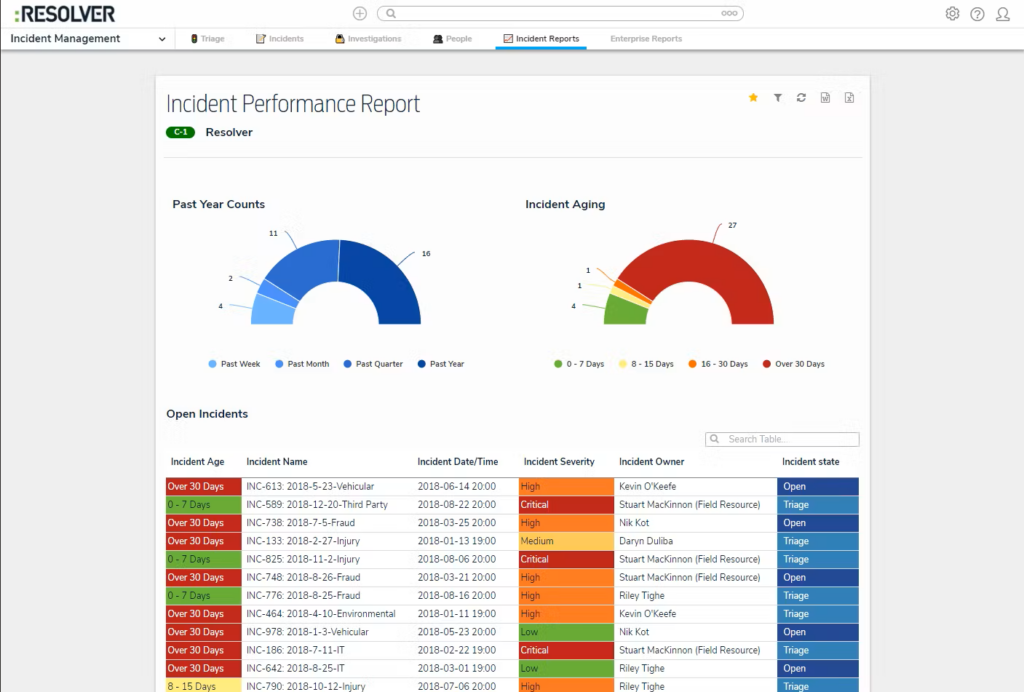

6. Resolver - Best for global risk analysis

Resolver is a platform designed to provide global risk analysis, facilitating an organization's ability to understand, manage, and monitor risks across the world. By offering a comprehensive view of risks and allowing users to analyze and respond to them in a holistic manner, Resolver stands out as the best tool for global risk analysis.

Why I Picked Resolver:

I chose Resolver after comparing various tools for global risk management, and it stood out due to its sophisticated analysis capabilities. What makes Resolver different is its capacity to integrate data across multiple geographies, providing a unified view of risks.

In my judgment, Resolver is best for global risk analysis because it facilitates understanding and handling of risks on an international scale, connecting disparate data points to offer actionable insights.

Standout Features & Integrations:

Resolver offers features that allow organizations to visualize, report, and analyze risks from different parts of the world. Its dynamic risk modeling and customizable risk scoring enable detailed and tailored risk assessments.

The tool integrates well with other systems, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) platforms, allowing a more seamless flow of data for comprehensive analysis.

Pricing:

Pricing upon request

Pros:

- Robust global risk analysis with customizable features

- Integrates with various ERP and CRM systems

- Capable of handling complex, multi-location risk structures

Cons:

- Lack of transparency in pricing

- May require specific training to utilize fully

- Complexity might be daunting for small organizations

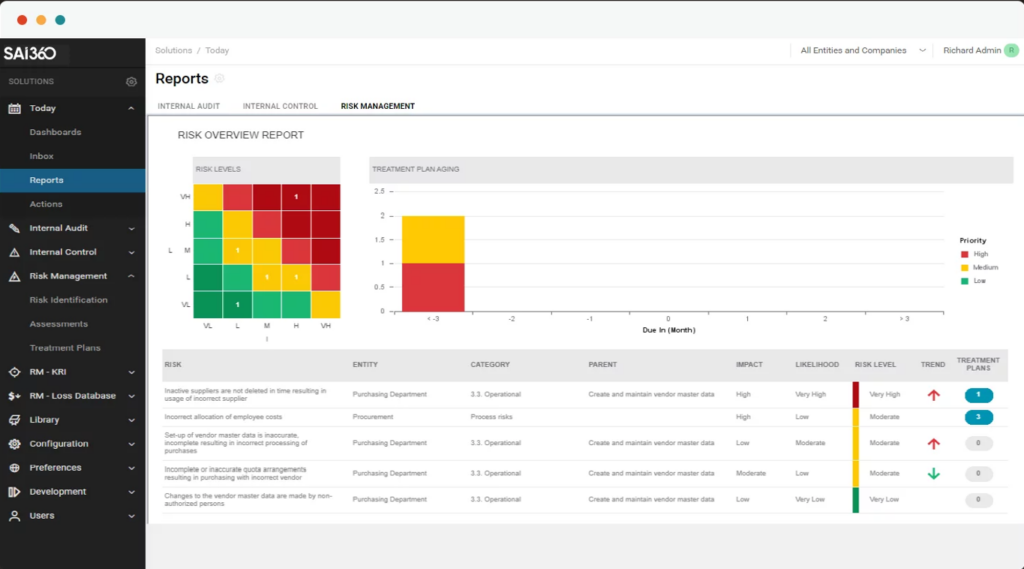

7. SAI360 - Best for integrated governance, risk, and compliance

SAI360 is a software platform designed to provide integrated solutions for governance, risk management, and compliance (GRC). By unifying these critical aspects of business operations, it allows for streamlined monitoring, reporting, and management of organizational governance structures. It's best for integrated governance, risk, and compliance, as it brings together these essential elements under one platform, enhancing efficiency and effectiveness.

Why I Picked SAI360:

I selected SAI360 after evaluating various GRC solutions, recognizing its unique ability to offer an integrated approach. What makes SAI360 stand out is its cohesive and flexible template, which adapts to different industries and organizational needs.

Based on my comparison and judgment, SAI360 is best for integrated governance, risk, and compliance due to its unified platform that simplifies complex processes while providing in-depth analysis and control.

Standout Features & Integrations:

SAI360 provides features like risk mapping, compliance tracking, and governance structure modeling. Its real-time dashboard allows for easy monitoring and decision-making. Among the integrations, it includes connections to various third-party financial, legal, and HR systems, enabling a 360-degree view of the organization's governance, risk, and compliance landscape.

Pricing:

Pricing upon request

Pros:

- Comprehensive integration of governance, risk, and compliance

- Real-time monitoring and decision support

- Adaptable to different industry requirements

Cons:

- Lack of transparency in pricing

- May require significant time and resources for implementation

- Complexity may make it less suitable for smaller organizations

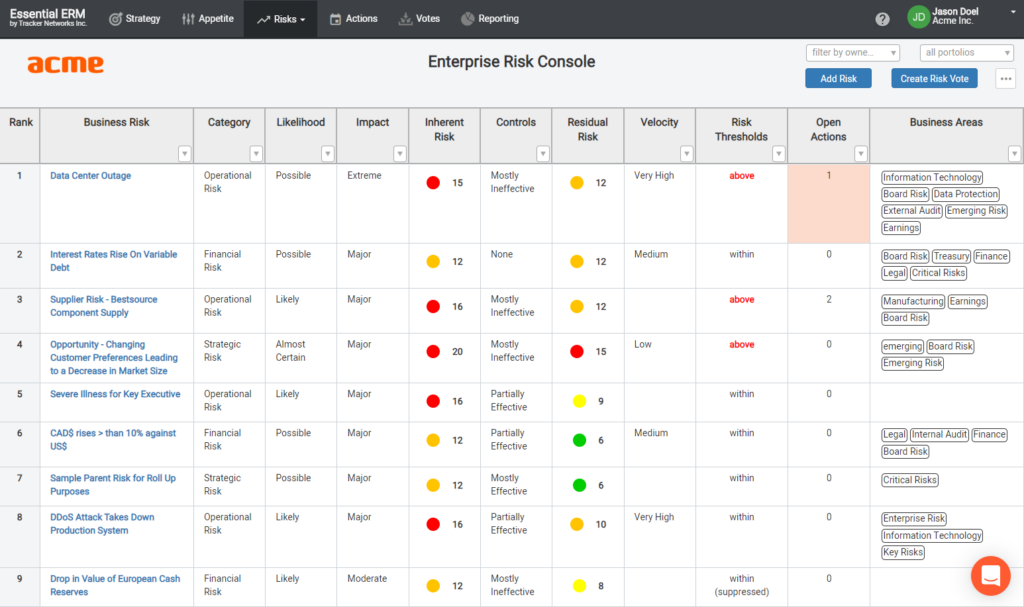

8. Essential ERM - Best for enterprise risk management

Essential ERM is a web-based Enterprise Risk Management system designed to assist organizations in identifying, evaluating, and prioritizing risks across the enterprise. It offers a comprehensive framework for managing these risks, helping companies align their strategies with regulatory requirements and business goals.

This makes it the best enterprise risk management software as it focuses on coordinating risk control activities and reporting functions across an organization.

Why I Picked Essential ERM:

I chose Essential ERM after careful analysis and comparison of various risk management tools. Its dedicated focus on enterprise-wide risk control, along with customizable features, led me to select this tool for the list. Its ability to connect various departments within a company under a single risk management strategy makes it stand out and justifies why I consider it best for enterprise risk management.

Standout Features & Integrations:

Essential ERM comes with features such as risk heat maps, regulatory compliance tracking, and automated reporting. These features work together to provide an intuitive and complete view of the enterprise's risk landscape.

Important integrations include connections with financial software, human resource systems, and legal compliance databases, which make it easier for different departments to collaborate on risk management.

Pricing:

Pricing upon request

Pros:

- Specialized focus on enterprise risk management

- Customizable features to suit different organizational needs

- Facilitates cross-departmental collaboration

Cons:

- Pricing information is not readily available

- May require specialized training to fully utilize

- Might be over-complex for smaller businesses

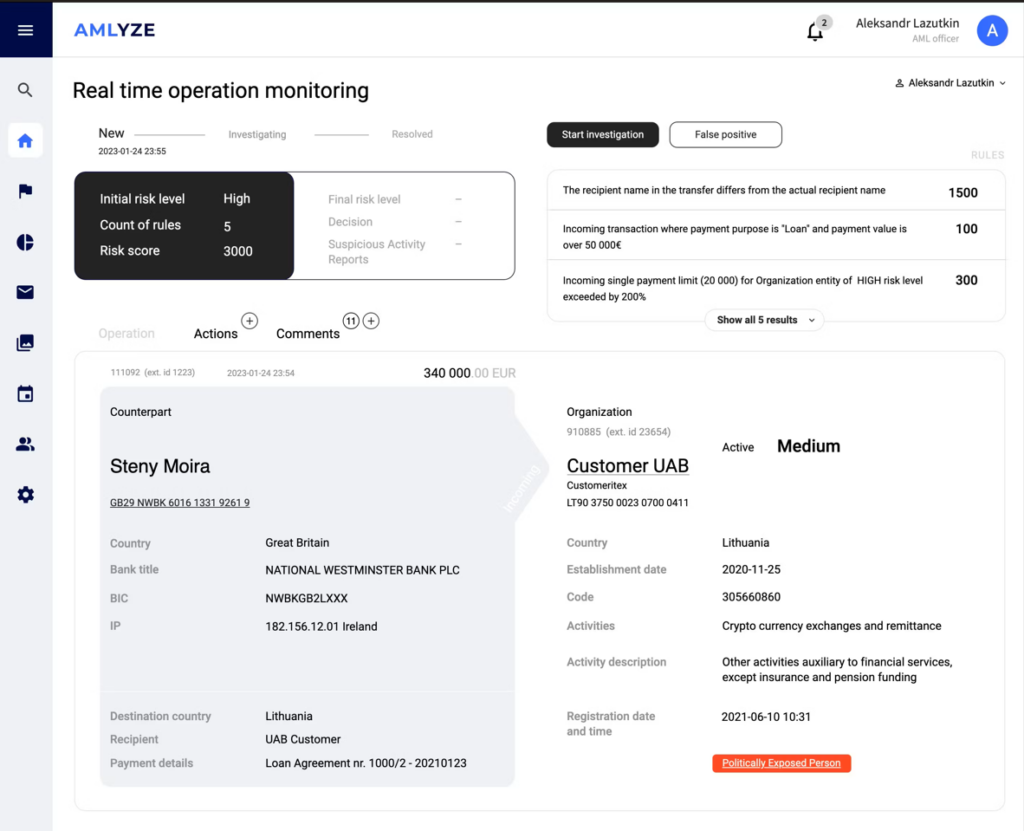

9. AMLYZE - Best for cryptocurrency risk assessment

AMLYZE is a specialized tool for assessing and analyzing the risks associated with cryptocurrency investments and trading. It provides users with comprehensive insights into market trends, volatility, and potential investment dangers. This focus on cryptocurrency-specific risks explains why it is best for cryptocurrency risk assessment, offering a targeted solution for those engaged in digital currency trading or investment.

Why I Picked AMLYZE:

I chose AMLYZE for this list after evaluating various tools designed to analyze risk within the financial sector. What makes AMLYZE stand out is its emphasis on the rapidly growing and highly volatile field of cryptocurrencies. Its ability to provide in-depth and relevant analyses for different cryptocurrencies aligns with the need for specialized assessment tools in this domain, justifying why I think it's best for cryptocurrency risk assessment.

Standout Features & Integrations:

AMLYZE offers features like real-time market monitoring, AI-driven risk predictions, and customizable alert notification settings based on user-defined risk thresholds. These functionalities are essential for anyone trading or investing in cryptocurrencies.

The platform integrates seamlessly with major cryptocurrency exchanges, data aggregators, and portfolio management systems, providing an end-to-end solution for managing crypto-related risks.

Pricing:

From $20/user/month (billed annually)

Pros:

- Tailored specifically for cryptocurrency risk assessment

- Real-time market monitoring and AI-driven predictions

- Integrates with major cryptocurrency exchanges

Cons:

- May not be suitable for those looking for broader financial risk management

- The pricing model may be challenging for individual investors

- Limited functionality outside the cryptocurrency domain

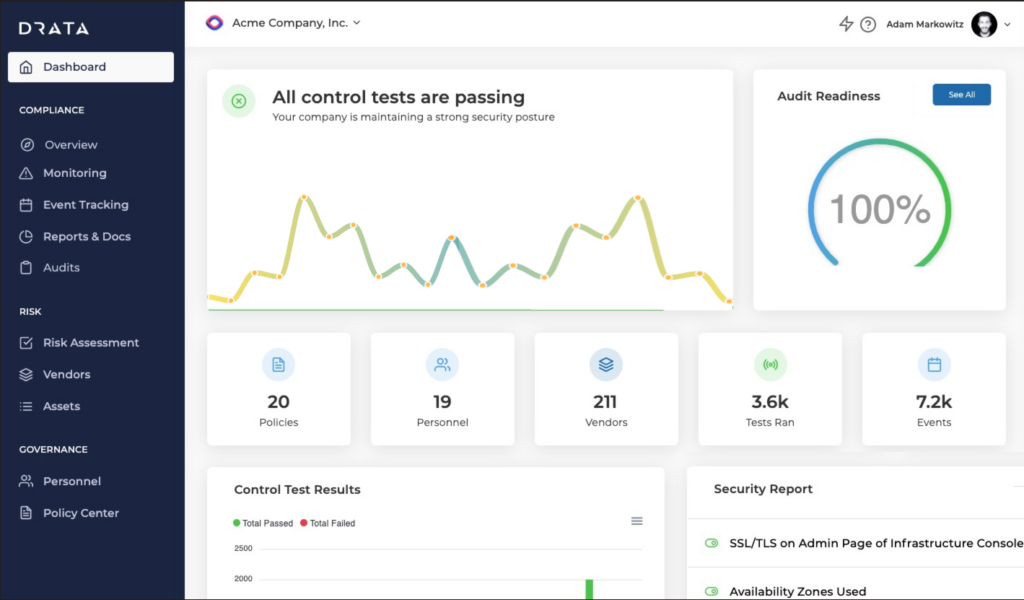

10. Drata - Best for automated security compliance

Drata is a platform that automates security compliance, helping organizations align with regulations, standards, and best practices. By automating and continuously monitoring compliance workflows, it ensures that companies can keep up with ever-changing security requirements.

Its focus on automation and real-time monitoring is what makes it best for automated security compliance, particularly for businesses that need to maintain strict adherence to security regulations.

Why I Picked Drata:

I selected Drata for this list because of its innovative approach to security compliance management. Its emphasis on automation not only saves time but also reduces the chances of human error. What distinguishes Drata from other solutions is its continuous compliance monitoring, which allows for immediate detection and response to any deviations from compliance standards.

This capability is crucial for organizations that need to maintain strict security postures, making it best for automated security compliance.

Standout Features & Integrations:

Drata's most significant features include automated evidence collection, real-time compliance monitoring, and customizable reporting. These functionalities ensure that organizations can quickly assess their compliance status and act accordingly.

Drata integrates with various cloud providers, identity management systems, and security tools, offering a unified view of compliance across different parts of an organization’s technology stack.

Pricing:

Pricing upon request

Pros:

- Comprehensive automation of security compliance processes

- Real-time monitoring of compliance status

- Integrations with various security tools and platforms

Cons:

- Lack of transparent pricing may make budget planning difficult

- May be overkill for small businesses without complex compliance needs

- Potentially steep learning curve for those new to compliance management systems

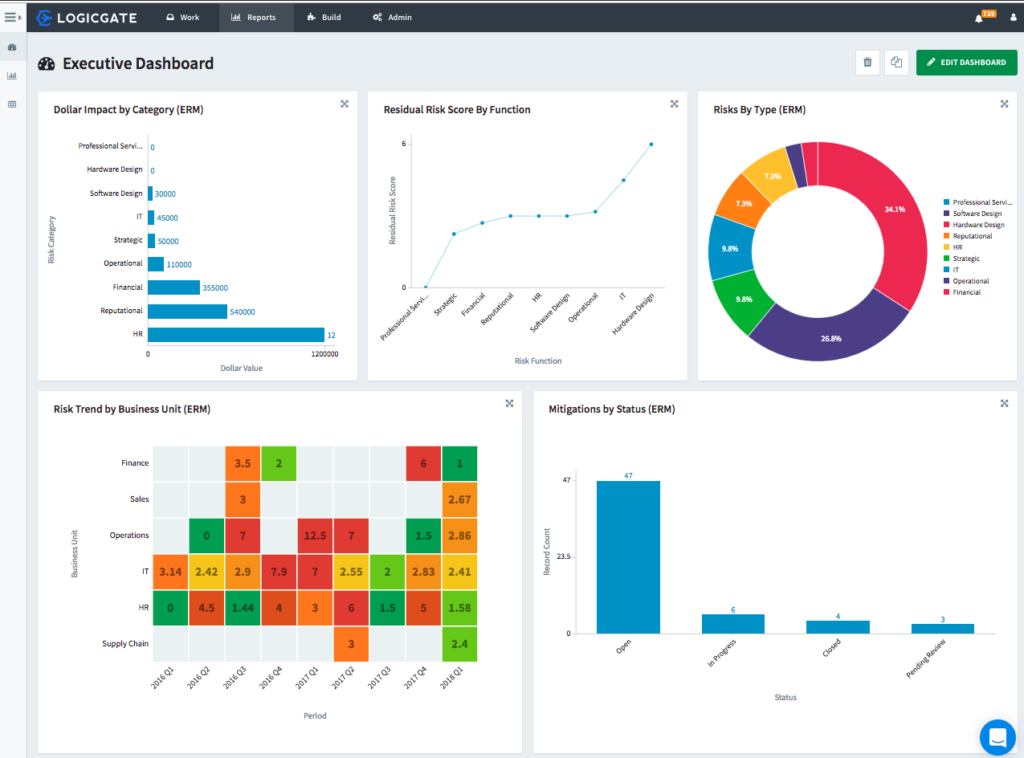

11. LogicGate Risk Cloud - Best for flexible risk program management

LogicGate Risk Cloud is a cloud-based risk management platform designed to manage risk across an organization through a highly flexible and customizable interface. It supports creating risk management frameworks tailored to specific needs, making it a fit for organizations of different sizes and industries.

The tool's adaptability in handling various risk management processes scenarios is what positions it as best for flexible risk program management.

Why I Picked LogicGate Risk Cloud:

I picked LogicGate Risk Cloud because of its unique ability to offer a flexible platform for managing diverse risk scenarios. The flexibility of the tool enables it to stand out by accommodating various risk management requirements, from compliance to operational risks.

Its ability to tailor the risk program to the unique needs of different organizations makes it best for flexible risk program management.

Standout Features & Integrations:

LogicGate Risk Cloud’s essential features include customizable risk management workflows, real-time risk reporting, and integration with existing systems and tools. These allow organizations to create a personalized risk program that fits their unique structure and needs.

LogicGate Risk Cloud integrates with various third-party systems, ensuring that risk data can be pulled from different sources, offering a more comprehensive view of the organization's risk profile.

Pricing:

Pricing upon request

Pros:

- Highly flexible and customizable to fit specific organizational needs

- Real-time risk reporting provides immediate insights

- Integration with various third-party systems allows for a cohesive view of risks

Cons:

- Lack of transparent pricing can make budget planning challenging

- May require technical expertise to set up customized workflows

- Potential over-complexity for small businesses with simpler risk management needs

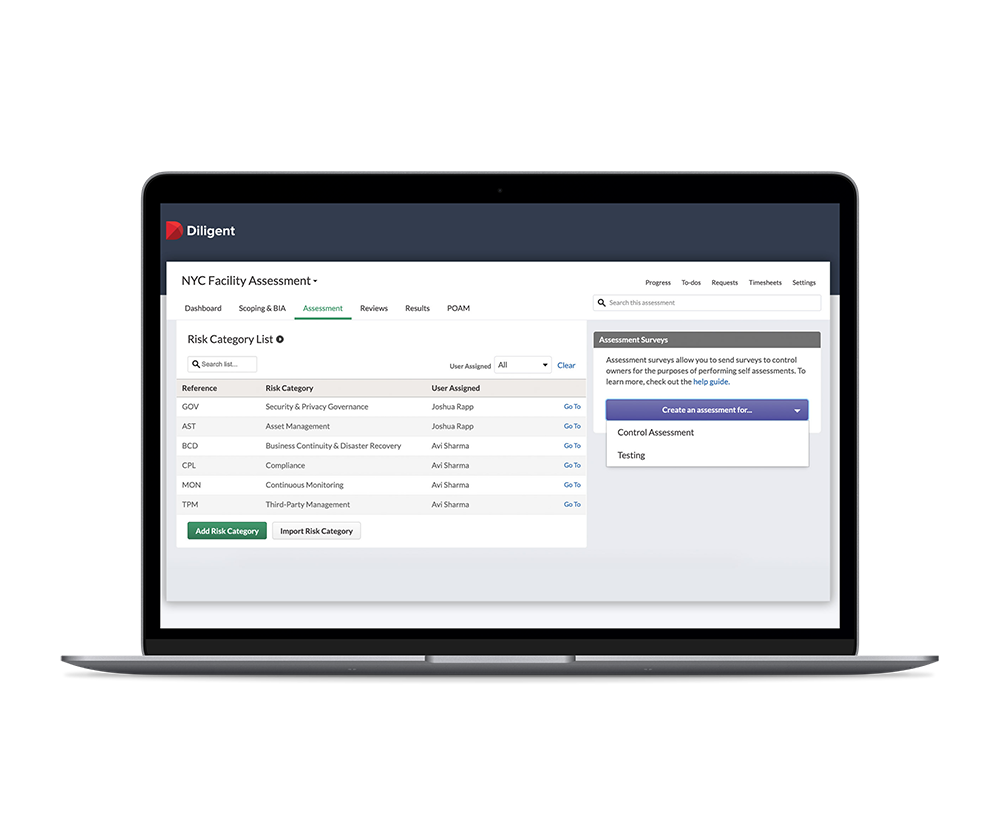

12. Diligent - Best for IT risk management solutions

Diligent provides a comprehensive suite of tools specifically designed to manage IT risks in various organizations. Its focus on IT governance, risk assessment, and security compliance aligns it with the demands of modern businesses, justifying its position as best for IT risk management solutions.

Why I Picked Diligent:

I chose Diligent for this list due to its specialization in IT risk management, an area that's becoming increasingly vital in our digital era. What sets Diligent apart is its integration of various aspects of IT risk into a single platform, providing an all-in-one solution. Its capability to manage IT-related risks and align them with business objectives makes it best for IT risk management solutions.

Standout Features & Integrations:

Diligent offers features such as IT governance tracking, cybersecurity risk assessment, and compliance management. These features contribute to a robust system that supports organizations in monitoring, evaluating, and mitigating their IT risks. Integration-wise, Diligent connects with major IT systems and software, allowing for seamless data flow and a more connected risk management strategy.

Pricing:

Pricing upon request

Pros:

- Specialized in IT risk management, providing focused tools and assessments

- Integrates with key IT systems for a comprehensive view of risks

- Offers governance tracking to align IT risks with business goals

Cons:

- Lack of transparent pricing may hinder budget planning

- May be overwhelming for smaller organizations without complex IT needs

- Some users might find the system’s extensive functionalities to be overly complex if not fully utilized

Other Risk Management Software

Below is a list of additional risk management software that I shortlisted, but did not make it to the top 12. They are definitely worth checking out.

- Cyabra - Good for detecting and analyzing disinformation campaigns

- SolarWinds Service Desk - Good for IT service management and support ticketing

- LogicManager - Good for enterprise risk management with centralized controls

- IBM OpenPages - Good for governance, risk, and compliance (GRC) within large corporations

- Wrike - Good for project risk management with real-time collaboration

- ProcessGene GRC - Good for streamlined governance, risk, and compliance processes

- Allgress Insight Risk Management - Good for providing a comprehensive view of organizational risk

- Quantivate IT Risk Management - Good for IT risk assessment and regulatory compliance tracking

Selection Criteria for Risk Management Software

When it comes to selecting the best risk management software, the process can be both exciting and daunting. With numerous tools available in the market, pinpointing the right one for your organization requires careful consideration. In my experience, having evaluated dozens of risk management tools, I was particularly focused on functionality, specific features, and usability tailored to the unique requirements of risk management. Here's what mattered most in my evaluation:

Core Functionality

Risk management software must fulfill several fundamental functions, including:

- Risk Identification: Ability to identify and document potential risks.

- Risk Analysis: Analyzing the possible impact and probability of identified risks.

- Risk Mitigation Planning: Creating plans to prevent or minimize the effect of risks.

- Compliance Management: Ensuring that all relevant regulatory standards are met.

- Reporting and Dashboards: Providing clear insights and visualization of the risk landscape.

Key Features

In my search for the ideal risk management tool, I specifically looked for these key features:

- Integration with Other Systems: Ability to communicate with other tools like ERP or CRM.

- Customization: Tailoring the tool to meet the specific requirements of the organization.

- Collaboration: Enabling team members to work together on risk assessments and plans.

- Real-time Monitoring: Continuous monitoring of risks and alerting as needed.

- Mobile Access: Accessibility through mobile devices for on-the-go monitoring and action.

Usability

The usability aspect was paramount in my assessment, focusing on these specific areas:

- Intuitive Interface: A user-friendly interface that doesn't require extensive training, with clear navigation and guidance.

- Quick Onboarding: The tool must allow new users to get started quickly, with minimal learning curves.

- Role-based Access Control: The ability to configure different access levels based on roles within the organization, enhancing both security and collaboration.

- Quality Customer Support: Availability of support through various channels like chat, email, or phone, along with a comprehensive knowledge base for self-help.

- Interactive Dashboards: Graphical representation of data, allowing for easy interpretation and understanding of risks and compliance status.

By focusing on these specific criteria, I was able to sift through the myriad of options and highlight the ones that truly stood out in terms of core functionality, key features, and usability tailored to the needs of risk management professionals.

Most Common Questions Regarding Risk Management Software

What are the benefits of using a risk management software?

Risk management software offers several advantages to organizations seeking to mitigate potential threats and uncertainties. Some of the key benefits include:

- Identifying and Analyzing Risks: These tools help in identifying potential risks and providing in-depth analysis to understand their impact.

- Compliance Management: Ensuring adherence to various regulations and standards becomes easier with automated compliance features.

- Centralized Data Management: Having all risk-related data in one place enables better decision-making and tracking.

- Customizable Solutions: Many tools offer customization to cater to the specific needs of different industries or businesses.

- Enhanced Collaboration: Team collaboration is facilitated through shared access to risk assessments, reports, and mitigation plans.

How much do risk management tools cost?

The pricing of risk management tools can vary significantly based on the functionality, size of the organization, and other specific needs. Some tools offer pricing based on the number of users, while others may have pricing based on features or data usage.

What are the common pricing models for risk management software?

Risk management software often follows one of these pricing models:

- Per User/Per Month: Charges based on the number of users.

- Feature-based Pricing: Different prices for different sets of features or modules.

- Custom Pricing: Tailored pricing depending on the unique requirements of the organization. Some providers might also offer tiered pricing, with packages ranging from basic to premium.

What is the typical range of pricing for risk management software?

The typical range of pricing for risk management software can be anywhere from $10/user/month for basic plans to over $100/user/month for more comprehensive solutions.

What are some of the cheapest and most expensive risk management software options?

The cheapest risk management software options might start as low as $10/user/month for minimal features, while the more expensive ones, designed for enterprise-level use with a plethora of features, could go beyond $100/user/month.

Are there any free risk management tools available?

Yes, some risk management tools offer free versions or trials, usually with limited features or for a limited time. These can be useful for small businesses or those looking to explore different options before making a commitment to a paid plan.

How do I choose the right risk management software for my organization?

Choosing the right risk management software requires understanding the specific needs and goals of your organization. Consider factors such as the type and level of risks you need to manage, integration with existing systems, scalability, user-friendliness, and of course, budget. It might be beneficial to take advantage of free trials or demos offered by various providers to get hands-on experience with the tool before making a decision.

Can risk management software integrate with other tools I’m using?

Most risk management software offers integration with other popular business tools like CRM, ERP, project management platforms, and more. This enables seamless information flow and collaboration between different departments within an organization, ensuring that risk management is aligned with other business functions. Always check with the software provider for specific integration capabilities that suit your needs.

More Risk Management Software Reviews

Summary

Selecting the best risk management software is a critical decision that can significantly impact an organization's ability to identify, analyze, and mitigate risks. The right tool can not only streamline processes but also align with specific business needs. Here's a helpful summary of the main points to guide your decision:

Key Takeaways

- Core functionality matters: Look for software that covers essential functions such as risk identification, analysis, mitigation planning, compliance management, and robust reporting. These core elements are vital to effective risk management and should be non-negotiable in your selection.

- Features tailored to your needs: Pay attention to key features like integration with other systems, customization, collaboration, real-time monitoring, and mobile access. The best tool for your organization will have features that align closely with your specific use case and industry requirements.

- Usability is key: Don't overlook the importance of an intuitive interface, quick onboarding, role-based access control, quality customer support, and interactive dashboards. These factors directly impact the user experience and can significantly influence how effectively your team adopts and utilizes the tool.

In summary, focusing on core functionality, key features, and usability will guide you in choosing the best risk management software for your needs. Take the time to evaluate these aspects in relation to your unique requirements, and you'll be well on your way to finding the tool that perfectly fits your organization.

What Do You Think?

If you've come across a risk management software solution that has impressed you or believe there's a hidden gem I might have overlooked, please feel free to share it. I'm always eager to learn about new tools and potentially include them in future updates. Your insights and recommendations are invaluable, and together, I can create a comprehensive resource for everyone in the field.